Recent Articles

President Macron and His Wife to Submit Expert Evidence in American Court About Brigitte Macron's Birth Sex

News • April Powell • Sep 18While Young Men Move Right, the Emergence of the 'Relaxed Female' Phenomenon Becomes Visible

News • April Powell • Sep 18Today's Top Highlights

Discover the latest stories and insights from our community

News

News

Trump v the Truth Overview: No Other Network Would Attempt TV So Audacious (while also) Exhausting

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Three Individuals Detained in Essex on Allegations of Supporting Foreign Espionage

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

The former president’s Case Against the Major Newspaper is Frivolous—However Creates a Significant Danger to Media Independence

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Novo Nordisk Shares Soar on Encouraging Anti-Obesity Pill Data

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

The Red Roses' Kildunne and Hannah Botterman Fit to Take On France in Semi-final

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

First Migrant Returned to France Under Fresh Reciprocal Policy

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Chicago's WNBA Team Mismanagement of Their Star Player Controversy

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

I have Seen Terrible Events at Football Matches – Yet The Thing That Fell on the Field Recently Was the Worst

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Three Individuals Arrested in Britain on Allegations of Espionage for the Russian Federation

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

Others

Others

Discovering the Rich Heritage in Asian-Themed Slot Games

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

The Rising Star Attracts Huge Audience at World Athletics Championships

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Exactly what is the American ‘antifa’ movement and for what reason does Trump seek it banned?

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

Recent Posts

News

News

News

News

News

News

News

News

September 2025 Blog Roll

August 2025 Blog Roll

July 2025 Blog Roll

June 2025 Blog Roll

Sponsored News

News

News

AI Will Never Replace My Authors. However, Lacking Regulation, It May Destroy Publishing As We Know It

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Global Track & Field Showdown: Thrilling Evening Featuring One-Lap Races, Sprint Qualifiers and More

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

The Federal Reserve's Independence Is Under an Unprecedented Challenge

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Kin of AI Tragedy Victims Sue Boeing Over Catastrophic Accident

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Positions: Jean Rhys in the Contemporary Era Review – Passion, Grit and Jungle Sweat for an Perpetual Outsider

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

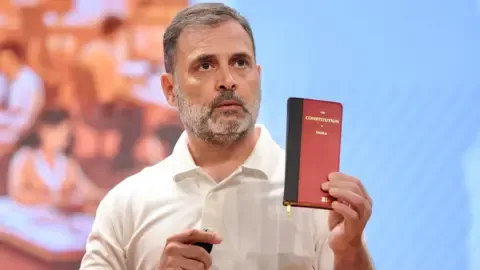

Opposition Figure Accuses Poll Panel of Shielding ‘Electoral Fraudsters’

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025