Latest

Update

News

News

Trump Indicates Keir Starmer May Employ Armed Forces to Secure UK Borders

April Powell

Sep 18

News

A Liberal Democrats Gathering: Representing Certain Regions of the Country

April Powell

Sep 18

Recent Articles

Tasty Delicacies for Catherine and Melania as They Entertain Scouts

News • April Powell • Sep 18Donald Trump's State Visit to Britain: Glamorous Appearances, yet Little Substance

News • April Powell • Sep 18Today's Top Highlights

Discover the latest stories and insights from our community

News

News

United Kingdom Preparing to Recognise State of Palestine as Early as Friday

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

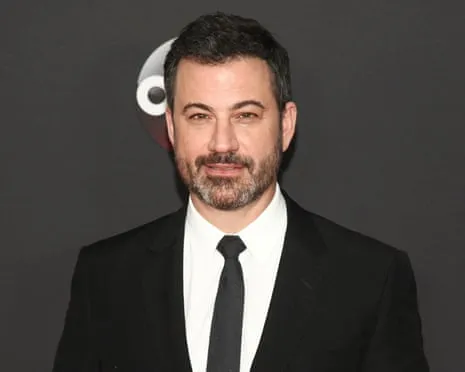

Trump Applauds Jimmy Kimmel's Suspension Amid Democrats' Anger Over First Amendment Issues

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

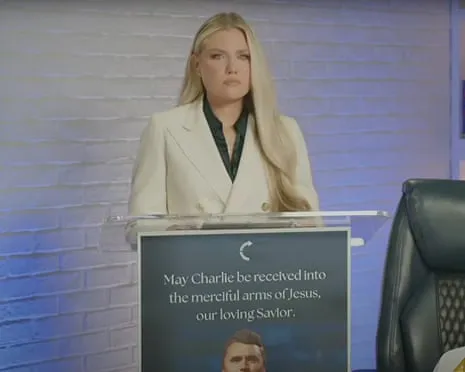

Mrs. Kirk Selected as New Chief Executive Officer of the Conservative Organization

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

News

News

The Late-Night Host Pulled Off Air For an Unknown Period—Who’s Next?

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

Realm of President Trump: The Way Media Moguls Are Bowing to Protect Crucial Agreements

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

UEFA Champions League Preview: Manchester City Host Napoli As Newcastle Challenge Barcelona

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

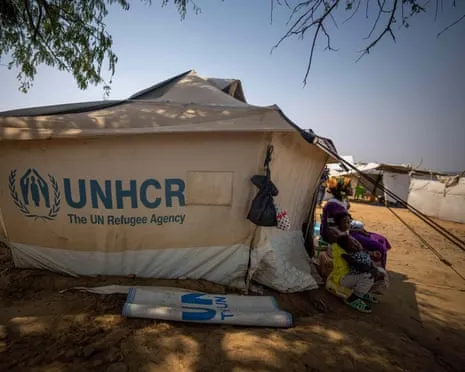

United Nations Faces Significant Financial Cuts and Workforce Layoffs After American Funding Cuts

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

Atletico Madrid and Uefa to Examine Alleged Spitting Event Throughout Anfield Fixture

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

Oscar Piastri and Norris Claim They Control Their Personal Fate in Formula One Championship Battle

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

Hodgkinson Escapes Boredom to Lift Team GB Morale in the Championships

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

News

News

Nationwide Walkout Movement Draws Massive Crowds Taking to the Streets Throughout France

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

📖 5 min read

Read More →

Recent Posts

News

News

News

News

News

News

News

News

News

News

September 2025 Blog Roll

August 2025 Blog Roll

July 2025 Blog Roll

June 2025 Blog Roll

Sponsored News

News

News

Corbyn and Zarah Sultana Clash Over New Party Membership

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Daredevil: Resurrected Officially Announced for Series 3

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Spanish Club Player Asencio to Face Trial Over Alleged Distribution of Private Video

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Mourinho Is Back at Sport Lisboa e Benfica After a Quarter Century: A Legend’s Gamble?

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

‘I’m a Hustler’: The Multifaceted Star on Her Art, Motherhood and One Battle After Another

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025

News

News

Roblox Brainrot Sensation Encounters Legal Snafu Leaving Players Freaking Out

By April Powell

•

18 Sep 2025

By April Powell

•

18 Sep 2025